Red flags when shopping for a car at a retailer

Cars are the subject that generated the most calls to our legal information line last year. Hidden fees, additional warranty sales, missing information about the condition of the vehicle...salespeople sometimes resort to questionable tactics to line their pockets. Here are 10 red flags to watch out for when shopping for a vehicle from a retailer*, whether new or used.

*Please note! The information on this page applies only to purchases of new or used vehicles from retailers. Transactions between individuals are subject to different legal rules.

1. The merchant does not hold a permit from the OPC

All new and used car merchants must have a license from the Office de la protection du consommateur (OPC) and display it in their establishment. Their license number must also be indicated on the sales contract.

To check whether the merchant has the required license, visit the Office de la protection du consommateur website and consult the section Get information about a merchant. This tool will allow you to verify whether the merchant has a license and whether it is still valid. You will also find information about the merchant's history, such as whether they have received formal notices or whether the OPC has issued press releases about them.

Good to know:

The merchant must provide a surety bond (a sum of money that serves as a guarantee) to the OPC in order to obtain a license. This sum may be used to benefit the consumer in the event that the merchant fails to meet their obligations. For example, if they go bankrupt, you could file a claim for compensation with the OPC.

2. The information label is missing, incomplete, or illegible

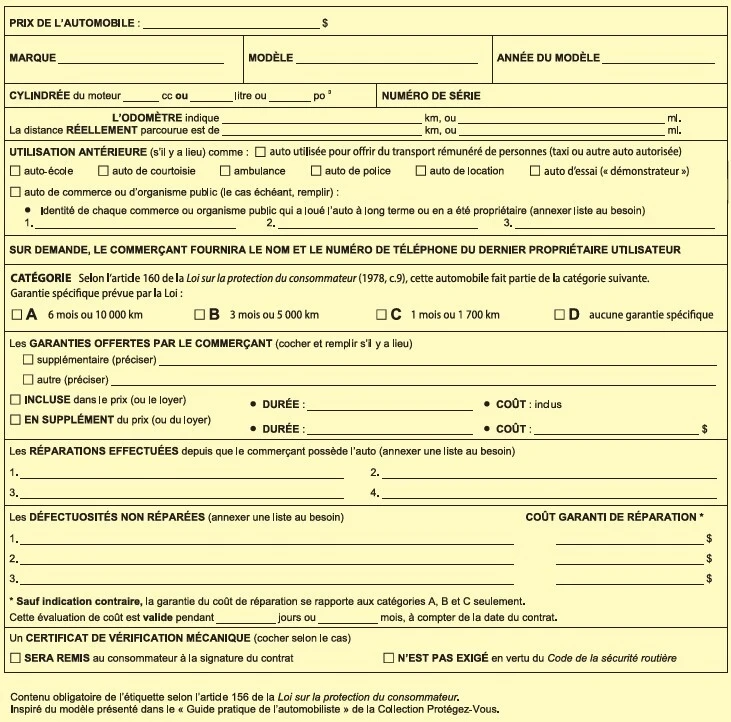

Each used car offered for sale must have a complete and legible label. This label must contain certain information:

- the sale price of the vehicle;

- the number of kilometers indicated on the odometer and the number of kilometers actually traveled by the vehicle, if different;

- a complete description of the vehicle (year of manufacture, serial number, brand, model, engine displacement);

- the category of the automobile (A, B, C, or D). This will determine the warranty of good working order of the vehicule;

- the characteristics of the warranty offered by the retailer;

- the fact that the automobile has been declared seriously defective, if applicable;

- a description of the repairs made since the retailer took possession of the automobile, if applicable;

- mention of the previous use of the vehicle if it has been used as:

- car used to provide paid transportation services (a taxi or other authorized vehicle),

- driving school car,

- rental car,

- police car,

- ambulance,

- customer car or test drive car (“demonstrator”).

If required to register the vehicle (for example, if the car comes from outside Quebec or has been declared a total loss), the merchant must also provide you with a mechanical inspection certificate when you sign the contract. At your request, he must also provide you with the name and phone number of the previous owner.

Please note:

The information label is an integral part of the contract and must be attached to it. This means that the vehicle must comply with what is indicated on the label, otherwise you may have recourse against the seller, with the exception of the sale price and warranty features, which may be modified according to your agreement with the seller.

Wondering what the label looks like? Here is an example, taken from the OPC website.

3. The seller won't let you inspect the car

Before buying a used car, it is strongly recommended that you have it inspected. The merchant is not required to provide you with an inspection report, but should not prevent you from obtaining these documents. The retailer must allow you to have the vehicle inspected by a mechanic of your choice and to take it for a test drive. If they refuse your request, this is a bad sign. Avoid going ahead with the transaction, as the car could have serious mechanical problems that will cost you a lot of money.

If the merchant offers to inspect the vehicle themselves, you are not obligated to accept and have the right to have the vehicle inspected by an independent mechanic.

In any case, request a copy of the inspection report and a written estimate of the work to be done. This will allow you to negotiate the price of the car based on the problems discovered or simply decide not to buy it.

Keep in mind:

Having a used vehicle inspected before purchase does not provide you with any additional warranty. However, this is an important step that can help you avoid unpleasant surprises by making it easier to come to an informed decision.

Tips:

In addition to inspecting and test driving a used vehicle, it is important to check its history report (also known as CARFAX) before purchasing it. This will provide you with additional information beyond what is found on the information label, including details about the number of previous owners and whether the vehicle has ever been in an accident. This report is sometimes provided by the merchant.

It is also essential to ensure that the car is fully paid for and free of debt, because the debt follows the vehicle! To do this, you can search the Registre des droits personnels et réels mobiliers (RDPRM).

4. We put pressure on you

Is the salesperson trying to convince you that you would be getting a bargain by buying a particular vehicle on sale? That other people are also interested in the vehicle and that you need to make a quick decision?

These are nothing more than high-pressure sales tactics. Don't succumb to the pressure that some retailers may exert to get you to buy a vehicle quickly. Not only is this type of practice illegal, but it can also be a sign that there is something wrong with the vehicle.

Warning:

If the merchant tries to make you believe that you can cancel the contract or get your deposit refunded if you change your mind, be wary! In fact, a contract can only be canceled under certain circumstances and within certain time limits. It is therefore incorrect to assume that you always have 10 days to cancel a contract. It is important to find out about the terms and conditions of cancellation before signing any contract.

If you have to leave a deposit, negotiate the smallest amount possible and have it stated in the document that it will be fully refundable if you change your mind.

5. The price is unclear

Are you being quoted a weekly or monthly price without any mention of the total cost? Is the interest rate or the payment period not mentioned? Ask questions!

Some salespeople may ask you how much you are willing to pay per month. They may then offer you a vehicle that fits your monthly budget, but without mentioning how many years you will be paying for it.

Tip: Take the time to shop around, compare prices, and ask questions. There's no shame in asking for details—it's YOUR money we're talking about! And if your gut tells you it's too good to be true, it probably is!

6. We add charges to your bill

When quoting the price, does the salesperson mention that they will have to add transportation and vehicle preparation costs or administrative fees? Adding these fees is illegal, and you can refuse to pay them!

The retailer is required to advertise an “all-inclusive” price that must include all applicable fees from the outset. The only fees that may be added to the advertised price are GST, QST, and the environmental fee for new tires.

Warnings:

If you choose to add options to the vehicle (e.g., sunroof, heated seats) or additional protections (extended warranty, rustproofing), the advertised price may be increased since these are additional items not covered by the initial price.

Similarly, if you choose financing, credit fees may be charged since the advertised price for the vehicle is for cash payment.

Before signing the contract, it is therefore important to find out the total price you will have to pay for the vehicle.

Tip: Take the time to read the contract and fully understand each of the fees included. You can even ask for a copy of the contract before signing so you can review it at home with a clear head. If the merchant refuses, be wary!

7. The retailer encourages you to purchase an extended warranty without informing you about the warranties provided by law

The salesperson tells you that you absolutely must purchase an extended warranty, that it's the only way to be protected in case of problems with the car. Don't fall into the trap!

Before offering you an extended warranty, the merchant must first inform you verbally and in writing of the existence of the legal warranty. This is free protection that automatically applies when you purchase or rent goods in Quebec.

To learn more about the different types of warranties, visit our website.

The merchant must also inform you that you have 10 days after purchase to cancel the extended warranty without incurring any fees or penalties.

In addition, when you buy a used car, it comes with a warranty. The length of the warranty varies depending on the year the car was released and its mileage (the category to which the vehicle belongs should be indicated on the information label). It covers parts and labor.

Tip:

Before purchasing an extended warranty, check whether it is really beneficial. For example, how long is the warranty valid for? How much will it cost you? Are there any items that are not covered by the warranty?

8. You are required to accept their financing plan

Is the retailer trying to force you to finance the purchase of your car or telling you that you will have to pay additional fees if you refuse the financing offer? These are illegal practices!

A retailer cannot force you to take out a loan to purchase a vehicle if you want to pay cash.

Good to know:

If you still want to finance your car, you are not obligated to do so through the retailer. It may be advantageous to shop around at different financial institutions to find the best deal for you.

9. If you finance the purchase, you are required to take out their insurance

In some cases, the retailer may ask you to take out insurance when purchasing your vehicle. Such insurance may be necessary, for example, when entering into a credit agreement. With this insurance, the merchant wants to protect itself in the event that you are no longer able to make your payments (due to disability or death).

However, even in this situation, you retain the right to choose your insurer or use equivalent insurance that you already have, provided that it meets the conditions set by the retailer.

As with financing plans, take the time to shop around to find the product that best suits your actual needs.

Did you know?

The salesperson is required to inform you of this right and cannot refuse the insurance you choose or hold unless they have reasonable and justified grounds for doing so.

DON'T CONFUSE THIS WITH!

In Quebec, the law requires all car owners to have at least $50,000 in insurance to cover their civil liability. This type of insurance is mandatory, whether you took out a loan to purchase the vehicle or paid cash.

10. Are you being offered a “second or third chance at credit” on a silver platter? Think carefully!

Second and third chance credit are forms of private loans generally offered to people who are experiencing financial difficulties and are unable to borrow from traditional financial institutions.

Merchants who offer this type of financing often advertise it in large letters in their storefronts to make it stand out and attract consumers who do not have access to traditional credit.

Do you think it's advantageous to use this type of credit? Think again! These are risky loans. The interest rate is exorbitant and can be as high as 34.99% (an interest rate above 35% could be criminal)! Hidden transaction fees may also be added

It is also important to understand the repayment period. Short-term repayment will save you a lot of interest, but will require you to make larger payments. Make sure you can afford these large payments while staying within your budget before signing! On the other hand, a long repayment period means you will make smaller payments, but you will pay much more in the long run due to the accumulation of interest. In the end, you may end up paying double or even triple the value of the car!

True story:

A consumer wanted to finance a car for $10,995 (+ taxes) and ended up paying $27,055.08 due to a multitude of added fees and high interest rates.

Tip: Before signing a second or third chance credit financing contract, take the time to make a budget and assess your financial situation.

You can consult our budget consultation service to help you get a clearer picture of your finances!